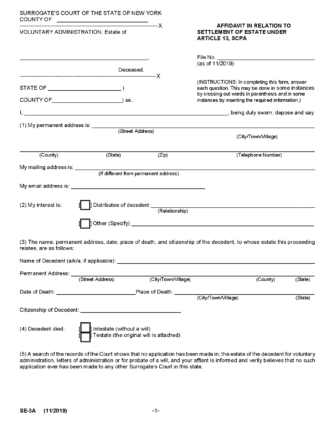

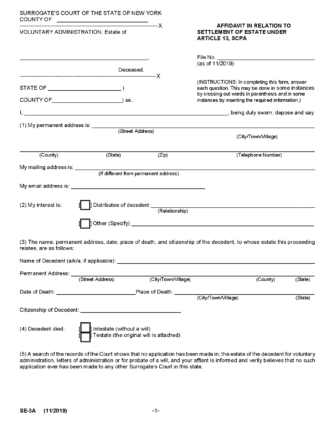

A New York small estate affidavit allows a beneficiary/distributee of an estate to obtain a decedent’s personal property without going through the standard probate process. The affidavit, officially known as the “Affidavit in Relation to Settlement of Estate Under Article 13,” appoints a voluntary administrator to collect a decedent’s property, resolve estate debts and expenses, and distribute the estate among distributees and beneficiaries. Estates valued at $50,000 or less that have no real property owned entirely by the decedent are eligible to be settled under this affidavit.

Note: Items listed under § 5-3.1 are not included in the estate valuation and are transferred automatically to the decedent’s family.

An Affidavit in Relation to Settlement of Estate Under Article 13 can be used if the estate’s total value is $50,000 or less (without accounting for property listed in § 5-3.1(a)), and the decedent did not own real estate solely in their name. The affidavit cannot be used if another application for voluntary administrator or letters of administration has already been made.

The order of priority of persons eligible to serve as a voluntary administrator is as follows:

The affidavit, death certificate, and original will (if one exists) must be filed with the court clerk in the county where the decedent was domiciled (will require a $1 filing fee).

If the decedent only had one distributee, or the distributees are part of the decedent’s extended family, a Family Tree Affidavit will need to be included in the filings and signed before a notary. The form can only be completed by a person that meets the requirements stated in UR 207.16(c).

After the documents are filed, the clerk will mail each distributee and beneficiary a notice of the proceeding (§ 1304(4)). The court will provide the voluntary administrator a certificate for each property or liability listed in the affidavit so that they may be collected in the next step (§ 1304(5)).

Note: New York provides an online Small Estate Affidavit program to help determine which documents will need to be filed.

The court-issued certificate can be presented to the estate’s debtors or custodians of the decedent’s property. Upon being served the certificate, the debtor or custodian must transfer the property or deliver payment to the voluntary administrator.

Note: The voluntary administrator will need to keep a record of all receipts and of distributions made and file the records with the Surrogate Court in the final step.

The voluntary administrator must open an estate bank account in a New York financial institution to deposit all funds received through the affidavit. They will also need to pay the estate’s administration and funeral expenses, and settle all debts using the estate’s assets. If necessary, the voluntary administrator is authorized to sell the decedent’s personal property and sign checks in the estate’s name.

The order of priority for resolving debts and expenses is outlined under § 1811.

Once all debts and expenses have been paid, the remaining estate can be distributed to the beneficiaries named in the decedent’s will, or if there is no will, in the manner described in § 4-1.1. Once the distribution is completed, the voluntary administrator will need to complete the Report and Account in Settlement of Estate Pursuant to Article 13 (Form SE-1D). The report must be filed with the Surrogate Court clerk and does not require any fee (§ 1307(2)).